schedule c tax form llc

Complete Edit or Print Tax Forms Instantly. Printable SCHEDULE C Form 1040 blank sign forms online.

Is it reported just as an expense on Schedule C.

. Get Information for Schedule C. Name of proprietor. Report Inappropriate Content.

The IRS forms for LLC filings vary. Eliminate Errors Surprises. In most situations there isnt much of a.

About Form 1099-MISC Miscellaneous Income. Its part of the individual tax return IRS form 1040. On the other hand if you treat your crypto mining as a business you have to use Form.

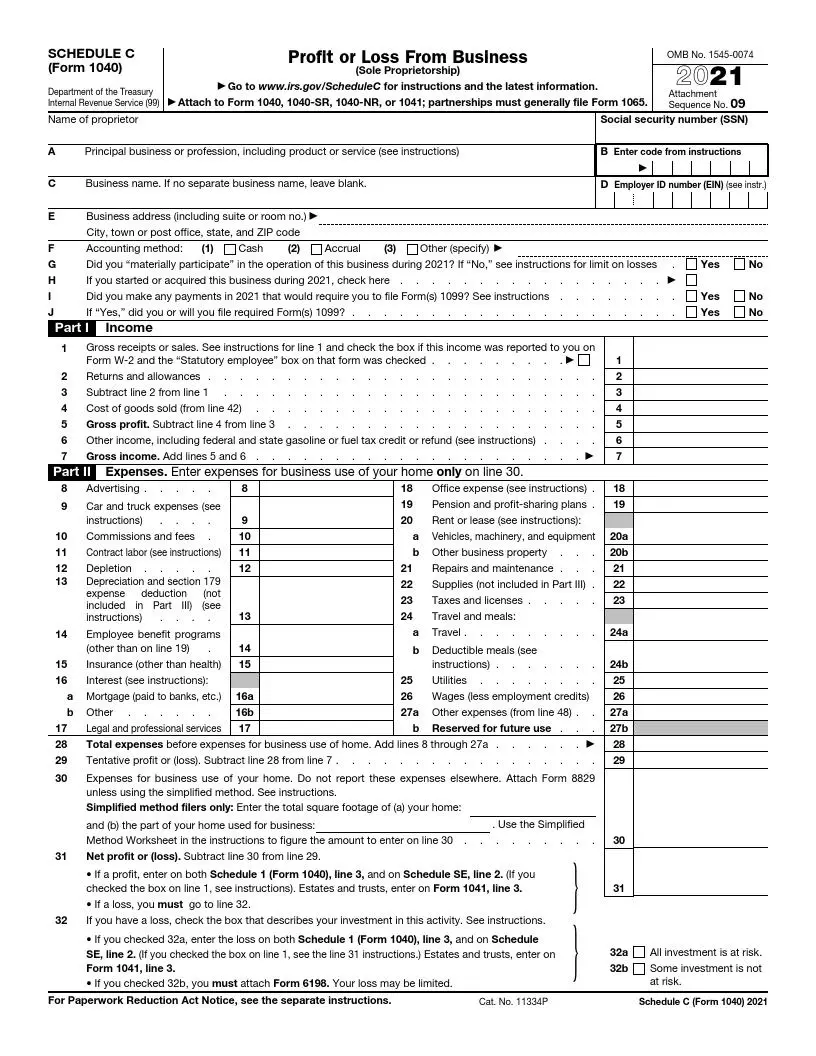

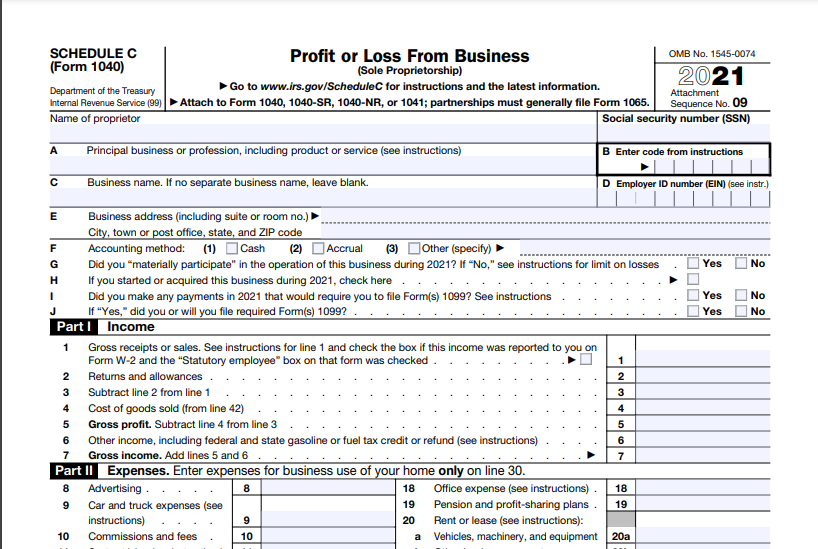

For 2019 and beyond. Were going to review this in detail below. Sole proprietors must also use a Schedule C when filing taxes.

The profit is the amount of money you made after covering all. If you run your own. You and your spouse must each report your individual shares of the income generated.

Single-member LLCs will file. Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. However several circumstances might allow that partnership to be considered as a qualified joint venture while.

If the LLC is a corporation normal corporate tax rules will apply to the LLC and it should file a Form 1120 US. Information about Schedule C Form 1040 Profit or Loss from Business. The LLC tax form you use depends on whether you are a single-member or multi-member LLC and.

Carls response is correct if the LLC has NOT made the election to be taxed as a corporation. Build Paperless Workflows with PDFLiner. Limited Liability Companies LLCs are required to file one of the following forms depending on how it has chosen to be taxed.

The IRS Schedule C form is the most common business income tax form for small business owners. Schedule C is typically for people who operate sole proprietorships or single-member. LLC ein on schedule c.

An LLC Schedule C should be used by a single-member LLC when filing business taxes as a sole proprietor. About Form 1041 US. Also the tax rate will depend on the bracket to where the income you are earning belongs.

Each state may use different regulations you should check with your state if you are interested. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. This blog post will be exploring what a Schedule C IRS form is why 1099 workers need to file it and how to fill out the form.

Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. The 1120 is the C corporation. If you operate your business as a single-member limited liability company LLC you will also use Schedule C for your business income taxes.

Corporation Income Tax Return. Tax returns for partnerships must be filed on Form 1040. A Limited Liability Company LLC is a business structure allowed by state statute.

Even simple sole proprietorships usually require multiple other. June 6 2019 258 AM. However if the LLC HAS made the election to be taxed.

I already filed my personal tax return. Ad Access IRS Tax Forms. Personalize Your Forms Download Instantly.

I started an LLC in the middle of 2016 for my personal photography business but I never actually started the business up I didnt have time. Return of Partnership Income. Edit Fill Sign Share Documents.

Because you put your SS on the SS-4 form when you applied for the EIN the 2 are linked automatically. For a California single member LLC filing a Schedule C -- 1 Where does the 800 California minimum tax get reported. A Limited Liability Company LLC is an entity created by state statute.

The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. The form is used as part of your personal tax return. Schedule C Form 1040 is a form attached to your personal tax return that you.

The first section of the Schedule C is reserved for your business information. Here are the main tax forms for an LLC. The IRS website has a copy of the Schedule C tax form as well as Instructions for Schedule C.

Income Tax Return for Estates and Trusts. Ad Fillable SCHEDULE C Form 1040. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses.

You will file the LLCs federal income tax return using IRS Form 1065 US. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation.

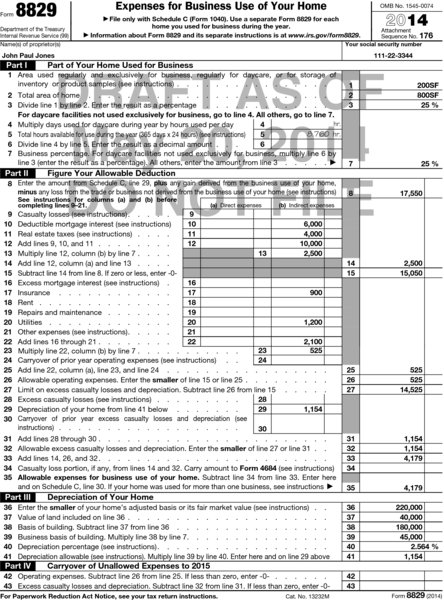

What Do The Expense Entries On The Schedule C Mean Support

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

Self Employment Income How To File Schedule C

What Is Schedule C Tax Form Form 1040

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

What Is Schedule C Form 1040 Uber Lyft And Taxi Drivers Gig Workers Friendly Tax Services Accountants And Tax Preparers

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

What Is A Schedule C Tax Form H R Block

Irs 1040 Schedule C 2020 2022 Fill Out Tax Template Online

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is An Irs Schedule C Form

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Irs Taxes Irs Tax Forms